Intro…

In my last post I explored some thoughts on Warren Buffett’s ‘certainty at a discount’ mental model. To really flesh out this idea I thought it would be beneficial to segway into a practical example and discuss a business I’ve been digging into recently that I feel may encompass some of the key attributes that typify this investing framework. In my view, this business is a high quality operation with a tremendous 30 year track record of consistent performance, currently facing some macro headwinds in an industry that has experienced significant distress in recent years. This has resulted in a 60% haircut to the stock price since its all time high in 2022. The company operates with both financial robustness and corporate integrity and I am tentatively optimistic that the wider market headwinds are now beginning to abate. As such it is my feeling that there may be an opportunity to buy into a quality enterprise at a time of suppressed valuation prior to a point of inflection.

The company in question is Hingham Institution for Saving (Ticker: HIFS). Hingham is a Massachusetts based regional bank that operates primarily in the Boston and Washington area with a small emerging presence in San Francisco. For this post, it is not my intention to do a full-blooded deep dive into the business - there is a brilliant in depth write-up already for those interested on a blog called the ‘Compounder Fund’ that I will link to at the bottom along with other useful resources. Instead, I see it as more beneficial to zero-in on some of the ideas discussed in the last post and look at the investment opportunity through the lens of Buffett’s ‘certainty at a discount’ mental framework, in an attempt to filter through any noise and get to the key factors that cut to the heart of an investment decision. As such, it will be illustrative to undertake a breakdown using the four key points constituting Buffett’s framework on risk that Hagstrom lays-out in his book ‘ The Warren Buffett Way’. To recap from the last post, these are;

“1 / the certainty with which the long term economic characteristics of the business can be evaluated. 2 / the certainty with which management can be evaluated, both as to its ability to realise the full potential of the business and to wisely employ its cash flows. 3 / the certainty with which management can be counted on to channel the rewards from the business to the shareholders rather than to itself. And 4 / the purchase price of the business”.

As mentioned, three of these four points are centred around the idea of certainty. Sadly, certainty normally comes with a fancy price tag, unless the company is going through a period of serious distress that scares investors away. ‘Thankfully’ Hingham is currently in the midst of such a period. It runs what is referred to as ‘a liability sensitive portfolio’. This meant that during the rapidly rising interest rate environment of 2022/23 costs ballooned, squeezing profitability whilst scaring investors away. This presents an opportunity but is nonetheless concerning, and it would be unwise to barrel into a situation like so without also having a comprehensive look as to whether the problems will be permanent or transient.

Are the problems temporary and can they survive them…

When a business undergoes a period of distress, as Hingham is in the midst of, I think it's firstly important to explicitly define the problems the business is facing, and then assess whether or not they stem from fundamental and permanent changes to either the business itself or its competitive position. If it can be ascertained that the headwinds are likely to be transient then an investor with a longer time frame can gain an edge in waiting for the clouds to dissipate and the sun to come through.

Rapidly Rising Interest Rates

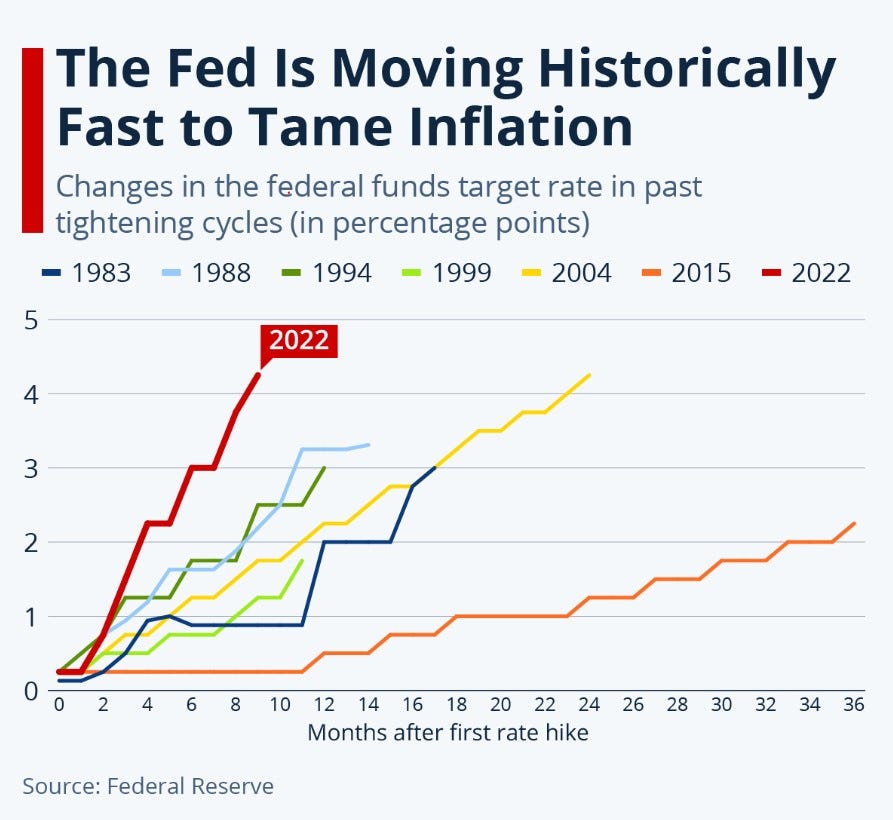

So what are the difficulties Hingham is facing? The first - and arguably most impactful - is the rapidly rising interest rate environment we experienced in 2022 and 2023. Hingham runs what is called a liability sensitive portfolio. This in essence means the liability side of the balance sheet readjusts to new rates much more readily than the asset side of the balance sheet. It is not high interest rates in-and-of themselves that is problematic, but instead their rapid rise. The period between 2023 and 2024 marked the fastest rate hike by the Federal Reserve in their history, as shown in figure below.

This affects banks like Hingham, as in order to continue to attract depositors they need to keep pace with rates being offered on short term government bonds and other short term products. On the flip side, the asset portion of their balance sheet - which largely consists of long term mortgages - takes time to rerate, as variable rate products largely remain fixed for a 5 year period before then readjusting on a yearly basis until maturity. As you may expect, during the lag phase - as assets catch up with liabilities - Hingham has experienced dramatic margin compression. Interest expenses have increased sixteen-fold in a 2 year period ballooning from $8m in 2021 to $126m in 2023, whilst the interest income has less than doubled, going from $110m to $174m. This has resulted in a halving of the net interest income from $102m to $48m which has of course frightened investors. But are the problems there to last?

Although I want to refrain from speculating too much on the future of movements of interest rates, I feel the probability of another sharp hike is very unlikely. The Federal Reserve has now held rates at a steady level for over a year and all the metrics - various inflation and employment indicators - are beginning to slow in the face of higher rates. Even if the Federal Reserve did see it as necessary to raise rates again in order to stamp out the last persistent piece of inflation, the chances of this being anywhere near the speed or magnitude of what has already been experienced would seem extremely unlikely. With interest rates remaining constant, the rate of net interest margin compression has started to abate. As management stated in their latest earnings release; ‘The pace of net interest margin compression slowed substantially as compared to prior quarters. The net interest margin appears to be stabilising at this point, as short-term market rates have remained stable, the pace of increase in the Bank’s deposit costs has slowed or reversed in some products, and asset yields continue to climb slowly and sustainably’ - Q1 Earnings Report 2024

It's worth also pointing out that a declining interest rate environment has the inverse effect on Hingham and offers significant tailwinds. This works in much the same way as previously mentioned, where the asset side of the balance sheet takes longer to adjust to the lower rates than the liability side, resulting in a period of margin expansion. This is what the company experienced in 2021, where interest rates were suddenly dropped to try and stimulate the economy in response to the pandemic. I am by no means implying that this is a likely scenario in the present, and there are many market forecasters suggesting higher interest rates are here to stay, but it does provide some additional upside potential if the economy does begin to stagnate and interest rates are cut.

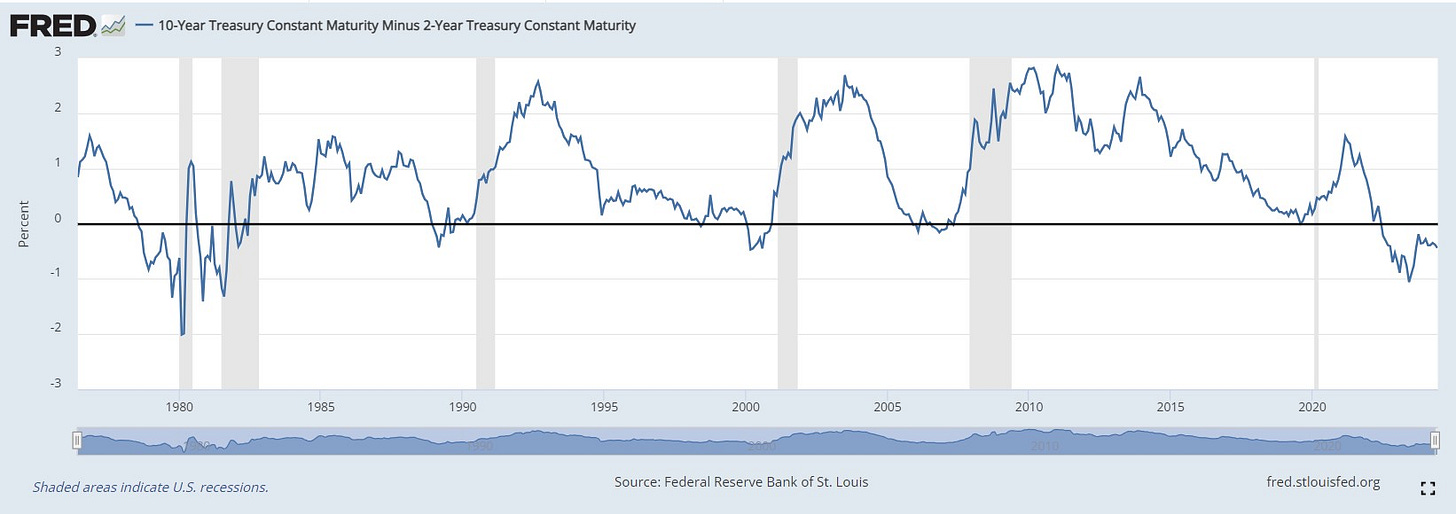

The Inverted Yield Curve

Another macroeconomic factor weighing heavily on Hingham’s performance is the historically long and deep inverted yield curve. Just to give a brief overview of the yield curve, this a graph that in essence plots the interest rates of government bonds against the time duration of those bonds. Under normal market conditions you would expect longer duration bonds to offer higher interest rates. This makes sense; if you lend someone your money for a longer period of time, there is inherently more risk involving either loss of capital or opportunity cost, which you will want to be adequately compensated for. The yield curve also reflects investors’ sentiment about the future of the economy however. Under healthy economic conditions where the economy is experiencing modest growth, one would expect interest rates to either remain stable or slightly increase to dampen any undesired inflation. This would result in a normalised yield curve, where the investor putting away money for a longer time duration would demand a higher interest rate as there is more likelihood of interest rates rising before their bond reaches maturity. Bond prices move inversely to interest rates, so if rates increase the value of the holder's bond will decrease. On the contrary, if the economy is in not-so-good shape, the government tends to try and stimulate growth by cutting interest rates. If the bond market feels the government is likely to cut interest rates they are more willing to put away money for longer and secure the higher interest rate. With more demand, long term bond prices are pushed up, reducing their yield whilst the opposite happens to short term bonds. This causes an inversion of the yield curve and is why historically it has been used as a fairly reliable indicator of a future recession. This can be seen in the figure below which shows 2 year bond yields subtracted from 10 year bond yields, with recessions shown as the dark grey bands.

Historically inverted yield curves are very the exception and not the norm. The figure above also demonstrates that inverted yield curves only exist for short intermittent episodes, and for the vast majority of time there is a profit to be made on the time duration of money. This is of course why Hingham runs a liability sensitive portfolio in the first place, as their business model takes advantage of the difference between short term and long term yields. In my opinion this makes a lot of sense as you want to design a business to perform well in the environment it will operate in for the vast majority of time as Patrick Gaughen remarked in this years annual report; ‘Yield curve inversions will occur and although they are difficult for our liability sensitive model, they are also ultimately temporary and they do not cause us to question our approach’. To use an analogy, it would be like compromising the design of a race car to be quicker through the gravel trap at the expense of speed on the tarmac.

With that being said, it is of course critical that the bank can survive these periods of inversion. As Howard Marks said “never forget the six-foot man who drowned crossing the stream that was five feet deep on average.” During this current inversion, despite the margin compression Hingham’s core business was still profitable and, largely due to the performance of the bank's minority equity investments, still managed to grow book value by 6% in 2023. Bear in mind this is the deepest and longest yield invasion in history, so so far, this is as bad as it gets. In addition, Hingham has also tried to use learnings from this experience to become even more robust; ‘Although we have employed certain strategies to reduce our risk in the event of additional increases in short-term rates, we see this as a low-probability scenario and we remain overwhelmingly liability sensitive’. One of these strategies has been to slightly modify their variable rate loans so that after 5 years they reprice every year as opposed to every 5 years making them slightly more rate sensitive. It is my sense that management is navigating this difficult environment competently and that the conditions are beginning to abate; “We are cautiously optimistic that this challenge will fade over this year. To the extent we can capitalise on the inverted yield curve and reduce liability sensitivity slightly via our wholesale funding activities, we will do so. This normalisation of the yield curve will eventually allow us to achieve more satisfactory returns as we obtain higher rates on new and adjusting loans and incremental funding pressure abates.” - Q1 Earnings Report 2024.

1 / The certainty of the long term economic characteristics of the business…

When Buffett talks about the certainty of long term economic characteristics, he is largely referring to the idea of a durable competitive advantage or as he famously calls it, ‘a moat’. Said differently, this is a unique characteristic or characteristics possessed by the business that enable it to somehow stave off the normal competitive forces of capitalism and continue to earn a higher than average return on the capital it employs. The slight irony here is that banking - by Hingham’s management own admission - is not really a very good business in the sense you can build the sort of competitive advantages seen in other industries. At the end of the day, borrowing and lending money is a commodity based business - okay there can be some switching-cost advantages as a result of the hassle in setting up a new bank account, or some differentiation achieved through superior customer service - but the reality is, if another bank is offering far better returns on deposits or lower rates on lending, customers are going to gravitate towards that particular business.

Low Cost Provider

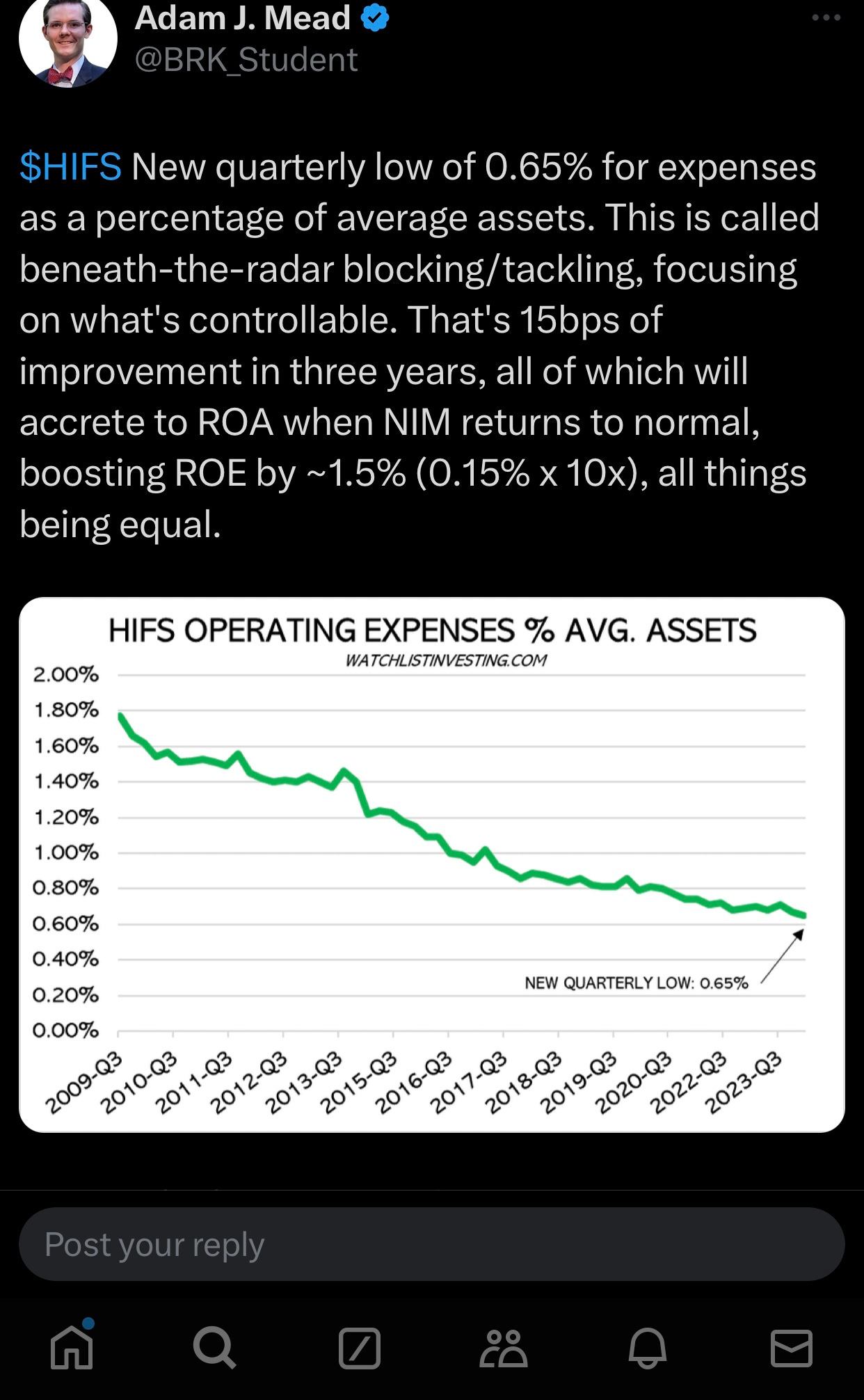

The only real way in which a commodity business can carve out a competitive advantage is by positioning itself as the low cost producer. For a bank, this means it can attract business by offering higher interest to depositors and lower rates to borrowers than competitors and still drive a profit because the other operational costs are lower in the business. This is exactly what Hingham has achieved, and more importantly, is continually obsessive in achieving. Management is obsessive about pulling costs of the business. Over their 30 year tenure, management has been able to bring the efficiency ratio down from 108% in 1993 to 25% in 2022. What's most attractive about this is that the cost reductions haven't come about in dramatic fits and spurts, but instead have been achieved through small incremental gains year-on-year. As CEO Patrick Gaughen said in this year's annual meeting; ‘How do we run the deposit and lending business in a high quality way… and do that in a way where every year we spend a little bit less as a percentage of the balance sheet’. Although in 2023 the efficiency ratio suddenly spiked back up to 57%, this was a result of the denominator shrinking as opposed to the numerator dramatically increasing (note the efficiency ratio is non-interest expenses / net interest income). To paint a broader picture, it's illustrative to look at the efficiency ratio in tandem with a ratio of the non-interest expenses to total assets. This stood at 0.67% for Hingham in 2023 which is highly impressive at about a quarter of the US banking industry average of around 2.4%. This point was also made by Adam Mead, author of ‘The Complete Financial History of Berkshire Hathaway’ in a recent X post.

Achieving this low cost position is something that is very hard for competitors to replicate. It is primarily down to a deep running culture of corporate frugality that takes real clarity of ambition at the outset as well as several decades of instigation to establish. However, it is not just the parsimonious culture but also very deliberate decisions regarding the type of businesses Hingham chooses to engage in - and maybe more importantly not engage in - that allows them to maintain low costs. They call this ‘game selection’.

Simple Business - ‘Game Selection’

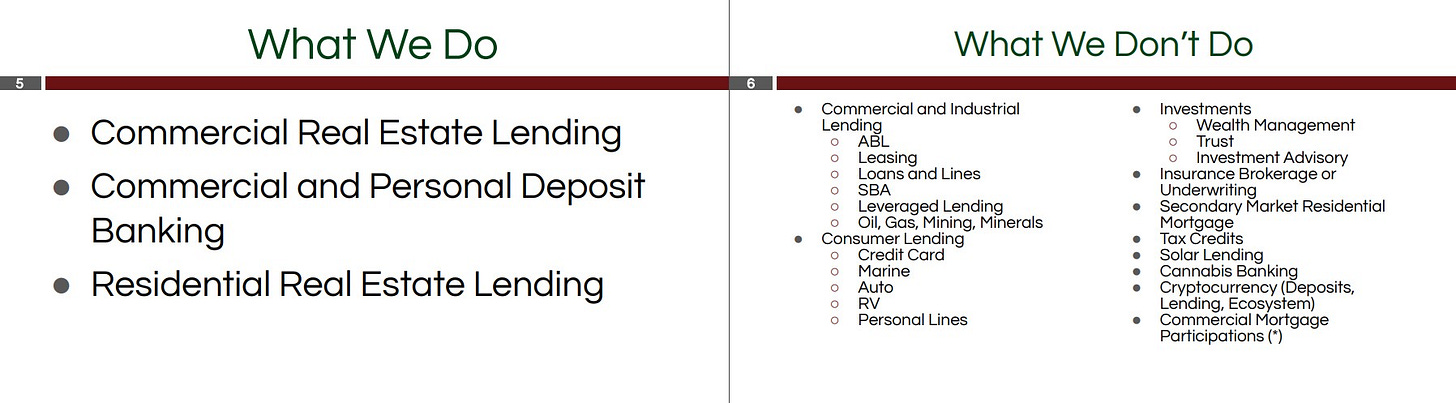

Hingham’s approach to banking is incredibly simple. In a world where there is no shortage of novel and gimmicky investment products, management has maintained a stanch adherence to their defined circle of competition. The slides below from this year's annual meeting demonstrate how the bank operates within three core areas of business, eschewing the wide ranging variety of other potential product lines.

This not only serves to boost operational efficiency - as they can optimise their energy and expertise towards their core business - but also makes the business much easier to understand for both management and the prospective investor. For management, this means they have a very clearly defined and well understood set of levers they can push or pull to guide the bank through changing market environments. For the investor, it provides far more transparency, intelligibility and confidence in the operations of the business. It is my feeling that oftentimes bank’s balance sheets can feel like black boxes to prospective investors, where the vast array and complexity of products can make it overwhelming to try and figure out their true value or real risk profile. In many ways the global finance crisis was an example of this, where debt products got packaged up in a way that obscured their real risk. Approaching the banking industry can feel like navigating a minefield with that many investors may prefer to just avoid. It is my feeling that this feeling of trepidation around the whole industry may have lead to a situation where the baby being thrown out with the bathwater. I certainly do not have the confidence that I fully understand a lot of these complex financial products and therefore avast amount of banks fail to pass the first filter in regards to being potential investment opportunities. In a sense, this whole investment thesis is predicated on the fact that Hingham only engages in straightforward and understandable areas of business.

Low Net Charge-Offs - ‘Game Play’

There is a real sense that at Hingham, management operates with a Berkshire-esque mindset, where emphasis is placed upon stupidity avoidance more so than trying to be smart all the time. Within their clearly defined area of competence; ‘Game Selection’, management is equally judicious in the way in which they choose to carry-out business and structure their lending; ‘Game Play’.

Firstly, Hingham underwrites loans at no more than a 50% loan-to-value ratio. This gives them a huge equity cushion in the event the real estate depreciates in value and the loan becomes distressed. For context, it is not unheard of for other banks to offer mortgages at LTV ratios closer to the 90-95% range. For Hingham the real-estate would need to lose close to half its market value for Hingham’s to incur a loss net of foreclosure fees. In addition to this measure, only loans personally assessed by the board - whereby they actually visit the physical asset that they are lending against - are carried on their books. This gives management a real sense of the nuances of each and every property they loan against and ensures any foreseeable oversight to be avoided. When combined, these two measures benefit Hingham’s loan book with a dual layer of protection that has rewarded the bank with industry-low Net Charge-offs as can be seen in the figure below.

Net Charge-offs are the actual losses incurred by the bank, net of recoveries, where the debt has become distressed and the bank has been unable to recover sufficient collateral as to cover the value of the initial loan. Its important to bear in mind that by their very nature, banks are highly leveraged institutions and as such sudden losses in asset value can be catastrophic for shareholder equity. As Patrick Gaughen CEO said at this year's annual meeting; ‘Credit risk kills banks, there are exceptions, but over the history of banks credit risk is the real killer’. Hingham’s NCOs are currently at 0% with only one loan of $460K showing any signs of late payment on loan book of over $3.5bn. This achievement should not be understated and as is representative of the company’s long-term outlook, embracing stability and resilience more so than short term optimisation and growth. This not only gives greater certainty towards the future continued operations, but it also allows the bank to hold lower levels of loss reserves for net charge-offs, creating a leaner operation, with more capital available for allocation into new lending.

2 / The certainty with which management can be evaluated, both as to its ability to realise the full potential of the business and to wisely employ its cash flows…

This filter really comes down to whether or not management are effective allocators of capital. As shareholders we want to see management deploy capital only in opportunities that create value for the shareholders, and if these opportunities don’t exist, to return excess capital to the owners. In this year’s annual meeting - prompted by a question regarding buybacks - Patrick Gaughen gave a broad overview of the way in which management thinks about capital allocation. Gaughen, highlighted that management consider all options available to them, as outlined in the image below, before concluding by saying that; ‘we continue to believe that the incremental return on the lending business is fairly attractive right now…and it really is a question of what generates superior returns over time for the owners’.

For the prospective investor, this sort of response is of course promising but when it comes to capital allocation talk can be cheap. As such, Mohnish Pabrai has frequently said, the surest means to assessing any management team's capital allocation is by studying their long term track record. Fortunately, at Hingham, the current management team have a 30 year track where they have been able to compound book value at around 12% per year. This is especially impressive as they have done so whilst taking on minimal risk and growth has been consistent with incremental gain each and every year, through different economic environments and market cycles. As such, book value has doubled roughly every 6 years and - with CEO Patrick Gaughen being only 39 years of age - it's reasonable to assume there is a decent runway ahead. Likewise, regarding the runway for new investment opportunities, management plans to use the same playbook of lending based on safety and return in the regions they already operate while also prudently expanding into new geographies when opportunities present themselves. Hingham predominantly operates around Boston and Washington DC but in the last few years has begun to establish a burgeoning presence in San Francisco. Management’s strategy is to focus on ‘Gateway Cities’ as they feel their supply-demand characteristics are felicitous to preserving asset value. This is predicated on the idea that the supply of new stock is in some way limited - whether this be by water or topography - and that the demand side is bolstered by new waves of immigration into these entry portals of America. Thus far, this strategy and its effective execution, has allowed Hingham to generate attractive returns and it is my feeling that they will be able to continue along this path.

3 / The certainty with which management can be counted on to channel the rewards from the business to the shareholders rather than to itself…

It is always comforting to invest your money alongside the people running the business; you both win and lose together. The Gaughen family are certainly proponents of this, and they own around 40% of the outstanding float which makes up a vast proportion of the family’s net worth. This alignment between owner and operator reduces any risk of management benefitting at the expense of the shareholder through egregious salaries or bonus packages for example. Although the Gaughen’s are a family of dyed-in-the-wool bankers, at this year's annual meeting Patrick remarked; ‘we don't think of ourselves as bankers, we think of ourselves as shareholders and owners first’. Knowing that management is ‘eating their own cooking’ gives a certain level of reassurance that shareholders will be treated fairly and favourably. It also gives reassurance that management will take every action possible to avoid jeopardy and mitigate risk which certainly helps with sleeping at night. As Chairman Robert Gaughen Jr has said; ‘When you're lending your own money you have a tendency to do it differently than someone else's money, it's a very effective means of risk management’. I don’t think I need to belabour this point too much, but I will conclude by saying that with current management in place, I am optimistic that shareholders will continue to be looked after at Hingham.

4 / the purchase price of the business…

The last filter on Buffett’s risk checklist is the price paid for the business. After all, even if a company delivers strong performance and earnings growth, returns to the investor can still be mediocre in the event that they have paid a too high price for those earnings at the outset. This is why - although Buffett is willing to pay-up for quality businesses - seldom does he loosen the purse strings enough to pay anything in excess of a P/E of 15. A P/E of 15 is historically the average Price / Earnings Ratio for the S&P 500 businesses and as such, any price paid above this brings into play heightened risk of downside market sentiment and permanent multiple contraction.

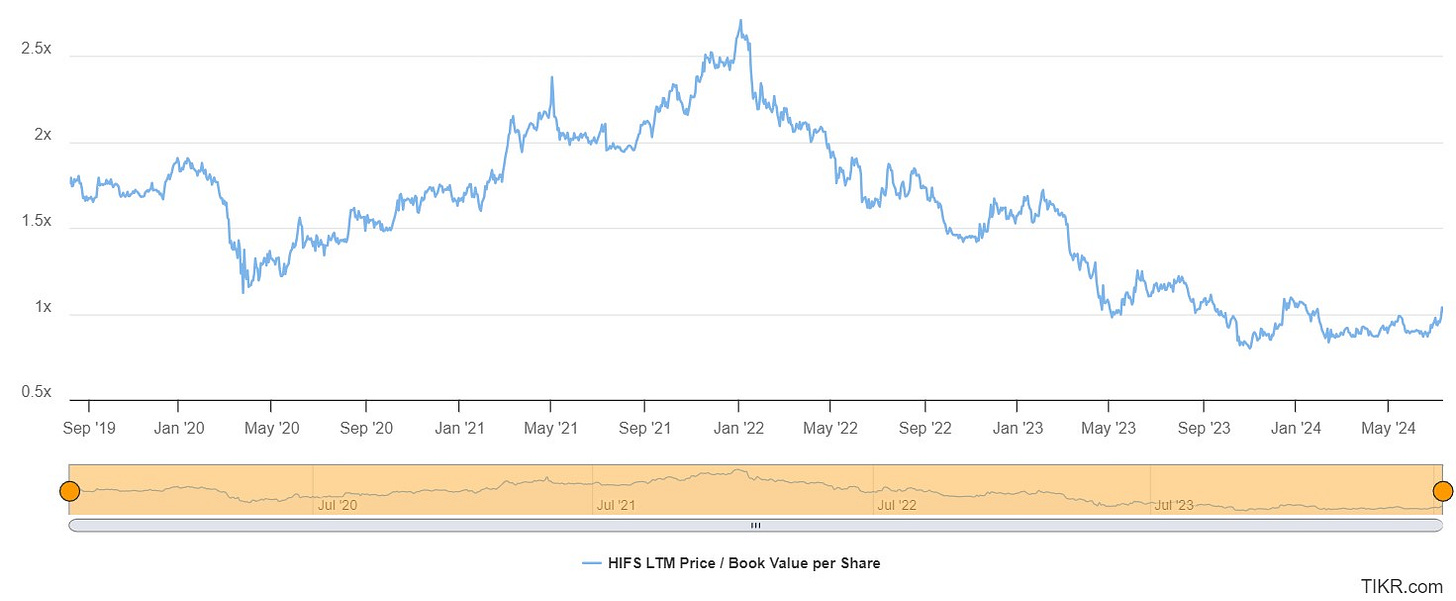

Banks generate earnings from their balance sheet and are as such oftentimes valued using an asset based approach in lieu of the more common earnings based approach which is typical for more standard businesses. Using an earnings based approach in isolation for a bank can land the prospective investor in hot water, as earnings can fluctuate more readily based on macroeconomic factors, where one may be drawn into paying what looks like a cheap price, only to discover that year’s results were uncharacteristically elevated. As such, looking at a bank's historical return on assets can be more illustrative in trying to estimate future returns. Hingham has a 10 year median return of assets of around 1.3%. This has been as high as 2.25% in 2021 and as low as 0.63% in 2023. In addition, the bank has historically held an assets/equity ratio of around 10x. This is effectively the amount of operational leverage present in the business and as such Hingham has had an average of return on equity over the past 10 years of close to 13% (10 x 1.3). The last number to factor in the asset based approach is the price, we the investor are paying for that equity. As you can see in the figure below, Hingham is actually trading a discount to equity of 0.9x. In other words, the market capitalisation of the business is slightly lower than the equity of the business.

Hingham’s 10 year mean Price / Book Ratio has trended closer to a 1.8x multiple . This has varied from the low near where it is currently to a high of 2.6x at the beginning of 2022. If we take a 5 year timeframe, and make the assumption that the P/B ratio reverts to the mean of 1.8x, this would give an additional 15% annual return over that time period. This would give the investor a total compounded annual growth rate of around 28%, or a 3.5x return in 5 years, which would appear very attractive. Any returns (or losses) in the equity portfolio would also have a bearing on this figure.

In addition to the asset based approach, I find using an earnings based valuation to be a useful sanity-check and additional perspective. In the first instance let's use a normalised earnings figure. Taking the numbers from above, a 1.3% ROA with total assets of around $4.5bn, in a normal market environment, Hingham could expect to generate core net income of around $60m which would suggest a normalised P/E ratio of around 6x or an earnings yield of 17%. If we look at Hingham’s suppressed core net income from 2023 of $14m, this would suggest a P/E of 25x. Although expensive, it is still not egregious, especially when we consider that overall net income was $26m if gains from the equity portfolio are included.

Taking both these valuations into consideration, the bank appears to be trading at an attractive level. However, this is very much dependent on whether the current headwinds will abate.

Thanks for Reading…

Thanks so much for reading I really hope you enjoyed this overview on HIFS and that its given you some colour on how I think about the ‘certainty at a discount’ mental framework. If you did enjoy the write-up please subscribe for free below and as you have read this far I would also really appreciate any feedback or thoughts on this post so please leave a comment and do not hesitate to reach out to me @InvestingLouis on twitter.

Just to finish-off, I wanted to leave you with a quote from this year's first quarter earnings report that I feel nicely summarises the outlook at Hingham.

“While the current market environment has been extraordinarily challenging, the Bank’s business model has been built over time to compound shareholder capital over an economic cycle. During all such periods, we remain focused on careful capital allocation, defensive underwriting and disciplined cost control - the building blocks for compounding shareholder capital through all stages of the economic cycle. These remain constant, regardless of the macroeconomic environment in which we operate. I believe that over the past twenty-four months we have retained this focus.” - Q1 Earnings Report 2024