Hello, you are reading ‘Something of Value’, a newsletter that aims to create mutual value by exploring all sorts ideas within the world of investing. Please note nothing below is investing advice and is for entertainment purposes only. If you do enjoy this post, please feel free to share and subscribe. Thank you.

Returning to The Dhandho Framework

In the recent round of 13F filings (Figure A) it came to light that Mohnish Pabrai had completely sold out of his positions in both Micron and Brookfield Corp, and had purchased new positions in a couple of US coal companies, Alpha Metallurgical Resources (AMR) and Consol Energy (CEIX). The move has certainly caught a lot of the value investing community off-guard and has caused a bit of a stir among the Pabrai faithful. The upset is largely justified as in recent years Mohnish has dramatically shifted his investment philosophy away from focusing on purely cheap stocks towards looking for high quality businesses trading at reasonable prices. He frequently talks about this in his interviews on ‘Chai with Pabrai’, even being jokingly self-depreciating, referring to himself - and his failure to recognise the benefits of this frame earlier on in his career - as ‘old too soon and wise too late’.

Figure A - Dataroma

This is why this bet on a couple of coal companies comes as such a surprise. Simply put, Mohnish’s new framework focuses on trying to find businesses with wide economic moats, high ROIC, and long runways for growth. Not only are they commodity businesses which typically have weak moats and low ROIC, they are also in an industry in cyclical decline as the world transitions to greener energy sources. To me this was exciting. It suggested Mohnish had likely found an opportunity that was so compelling (so cheap!) that it caused him to about-turn and return to his former framework. Sure enough, In an interview on ‘The Meb Faber Show’ (Youtube) a few days after, Mohnish compared the valuation of these coal businesses to an investment he made in IPSCO, a steel pipe manufacturer back in 2004/2005.

“Recently, the two stocks that I found in the US are like IPSCO. I never thought I would find that again, where the guaranteed cash flows exceed the market cap.”

He writes about the IPSCO investment at length in his book ‘The Dhanhdo Investor’ so I won’t go into too much detail about that here. In essence though, IPSCO was an opportunity where the business was trading at less than the net cash it currently had on the balance sheet, plus the cash it was guaranteed to generate as a result of pipeline construction contracts it had already signed, guaranteeing future cash flows. Mohnish got an added bonus with the IPSCO investment, whereby the company continued to sign additional contracts in future years guaranteeing more sales and as such in the 15 months he held the stock it generated a 3.7x return for his fund. It is a prime example of the Dhandho framework his book is centered around, which is the idea of 'Heads I win; tails I don't lose much'. In other words your downside is protected (in this case by the guaranteed cash flows from the pipeline contracts), with the possibility of big upside potential.

Okay so back to the coal investment. I thought it could be a great opportunity almost in real time, (okay one quarter too late!) to try and reverse engineer Mohnish’s analysis to try and figure out how he reached such an elegant conclusion - figuring out the business was trading below the guaranteed cash flows. The thing is, like anyone who is a master at what they do, Mohnish tends to make things look (or sound) incredibly simple and obvious. Of course anyone would make an investment in a company if it was trading at less than the guaranteed future cash flows. The real skill lies in the ability to distil down large swaths of information to garner the few important nuggets that allow such a simple verdict to be reached. As such I want to dig into the company’s filings and financials and try to figure out how Mohnish may have thought about this opportunity. I will caveat this all by saying I have never looked into a coal company (or any commodity company for that matter) in earnest before, so this analysis could be way off the mark. This is just my attempt to try and reverse engineer Mohnish's decision making process to try and glean some insight into the way he may have been analysing the numbers and thinking about this investment opportunity.

Reverse Engineering the AMR investment

For the sake of this exercise I want to focus purely on Alpha Metallurgical Resources (AMR) which is Mohnish’s highest conviction position making up about 80% of the bet. I want to work through a few calculations to try and figure how Mohnish may have been able to project out the cash flows. I also want to note that I am going to assume that at the time Mohnish made the purchase the Market Cap of AMR was c. $1.85bn. This makes the assumption he managed to get in at the Q2 lows, and also assumes a share count based on the company's rate of buybacks in that period.

The initial thing to note is that Mohnish refers to the ‘guaranteed cash flows’ of the business so initially I wanted to look out for anything that indicated confirmed future sales (similar to the IPSCO’s pipeline contracts). As a commodities business, AMR enters into futures contracts with coal buyers that in effect set a fixed price of a certain percentage of agreed upon future sales. Without getting into too much of the little knowledge I have on futures contracts, this contract basically acts in the interest of both parties as the agreed fixed price serves as a counter ballast against any future fluctuations in the commodity’s spot price. This enables both parties to insulate a portion of their business from the changing spot price which for the seller diminishes the upside if the price skyrockets while preventing catastrophe if it plummets, and vice versa for the buyer. In any case, this is useful for an investor as it gives insight into fixed sales for the business.

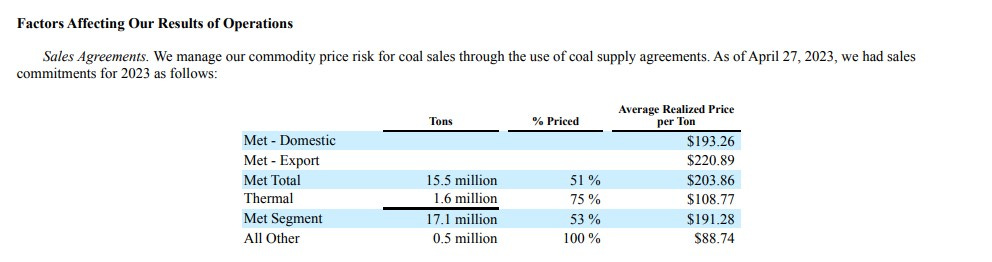

In the case of AMR they have a section in their 10Q called ‘Supply Agreements’ where they give a simple breakdown of these fixed price future sales contracts. Figure B is a table from AMR’s 2023 Q1 report giving a breakdown of these ‘Supply Agreements’ as of April 27th 2023. If we take the example of total metallurgical coal (Met Total), we can see AMR has agreed to sell 15.5 millions tons, of which 51% is being sold at a fixed price of $203.86. If we multiply that out (15.5x0.51x204), we can figure out that AMR has met coal agreed fixed price sales of c. $1.61bn. If we do the same for the thermal coal portion of sales we (1.6x0.75x109) we get another $130m in sales. If we also add the $44m in other fixed sales, we get a total fixed price sales of $1.8bn in sales.

Figure B - AMR Sales Agreement Q1 23

However, this doesn’t take into account the other 49% of metallurgical coal, and 25% of thermal coal that has agreed to be sold at spot price. Now, because it's at spot price it's fair to say that these are not guaranteed sales. I certainly have no insight into future movements in coal prices, so for the purposes of this exercise I will use the spot price at the end of Q1 2023. Figure C and Figure D show prices for metallurgical and thermal coal I found online and shows them at $244 per mt and $161 per mt respectively. (please note I am no expert on the units used for measuring coal pricing but these graphs reflect the price for a metric ton and AMR reports in short tons, as per the conversion I will knock 10% off these prices). Okay so with all sorted we can complete the calculation. (15.5x0.49x244) + (1.6x0.25x161) which gives us an additional $1.9bn in sales for a total of $3.7bn.

Figure C -Metallurgical Coal Spot Price

Figure D - Thermal Coal Spot Price

Okay, so we’ve got a figure for future sales with about half the number being completely guaranteed and the other half subject to spot price movements. The next step towards getting a figure for the cash flows is to figure out how much it will cost the company to extract the coal it is contracted to sell. We know from the table in figure B they have agreed to sell 17.1 million tons of met coal and thermal coal combined, so if we can get a number that tells us the cost per ton to mine the coal we can maybe figure out an estimate for cost of goods sold and gross profit. Looking at figure E, we can see that in H1 2023, AMR sold 3.9 million tons of coal with a ‘cost of coal sales’ of $538m. If we divide out these numbers we get a cost per ton of $138, and suggests that the cost to extract the contracted 17.1 million tons may be around $2.35bn dollars, assuming energy prices and other variable costs remain similar to the H1 2023 levels. If we net this out from contracted revenues (3.7-2.35), we get a gross profit of $1.35bn.

Figure E - AMR Sales and Expenses Q1 23

The next step is to get an estimate for the operating expenses of the business. AMR seems to have a pretty consistent operating expenses of c. $250m. If we assume they pay c. $100m in tax (which would be consistent with 2022 numbers for this profit level) and net these two values out we get to a net profit of $1bn. However as a large portion of the operating expenses are non cash expenses (Depreciation and Amortisation) we need to add these back in to get a figure for operating cash flows. D&A are c. $120m, which gets the estimated operating cash flow to $1.12bn.

This of course doesn't exceed the $1.8bn market cap Mohnish that said the guaranteed operating cash flows exceeded. So what makes up the difference? If we take a look at the current assets and current liabilities on the balance sheet in figure F we can see AMR has net current assets of c.$780m. In my opinion, For a business with contracted future sales, it makes sense to think of this as cash that is expected to flow into the business within the next year from previous operations. If we take inventories and prepaid expenses first, this is effectively c. $370m that we can subtract from the COGS of the contracted sales. The business has already borne the cost to extract that coal and therefore we don’t need to subtract it twice. If we take account receivables and account payables this is effectively cash the business expects to either flow in or out within the next year based on their previous business operations. If we net these out we get c.$350m.

Figure F - AMR Balance Sheet Q1 23

And there we have it. If we add the expected cash flows from future supply agreements and previous operations together (1120+780), we get an estimated cash flow of $1.8bn, equal to the market cap low in Q2 2023.

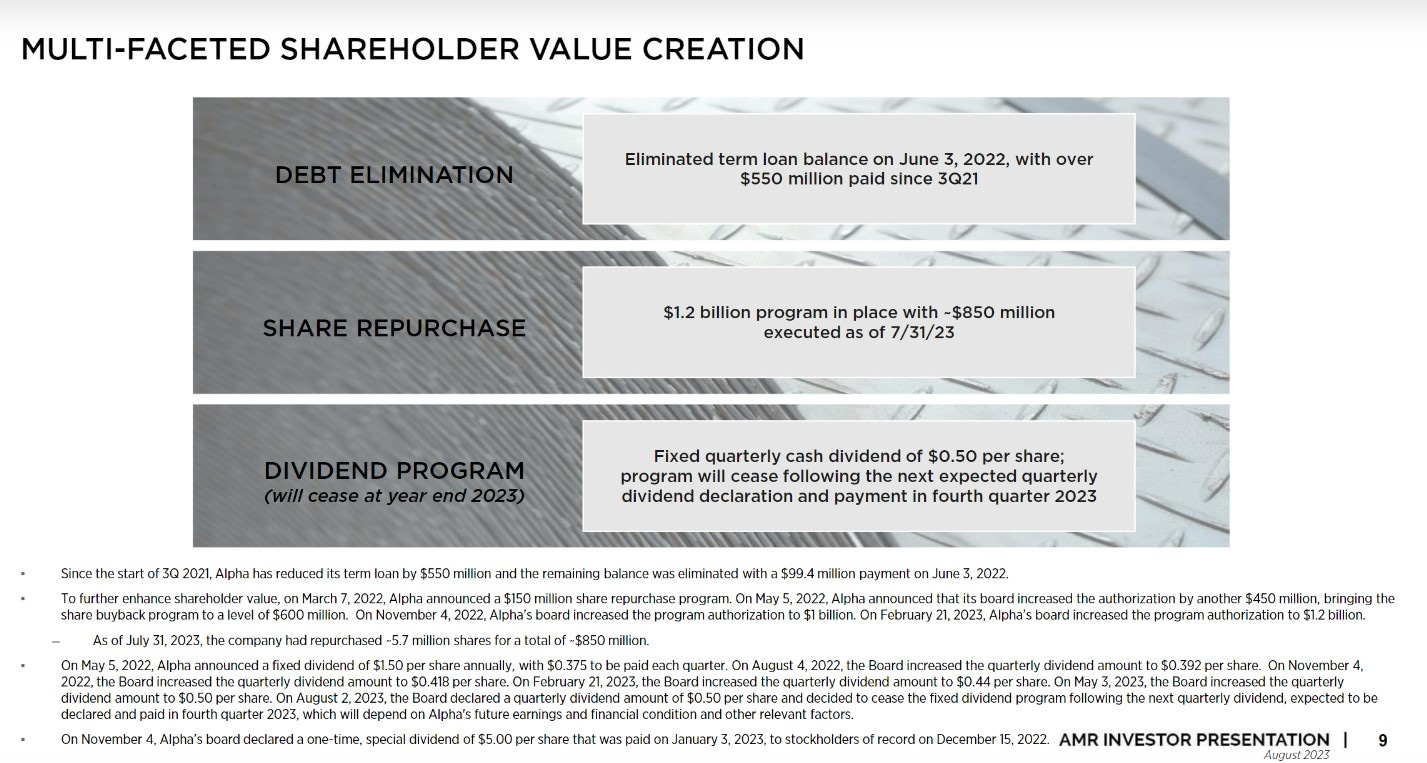

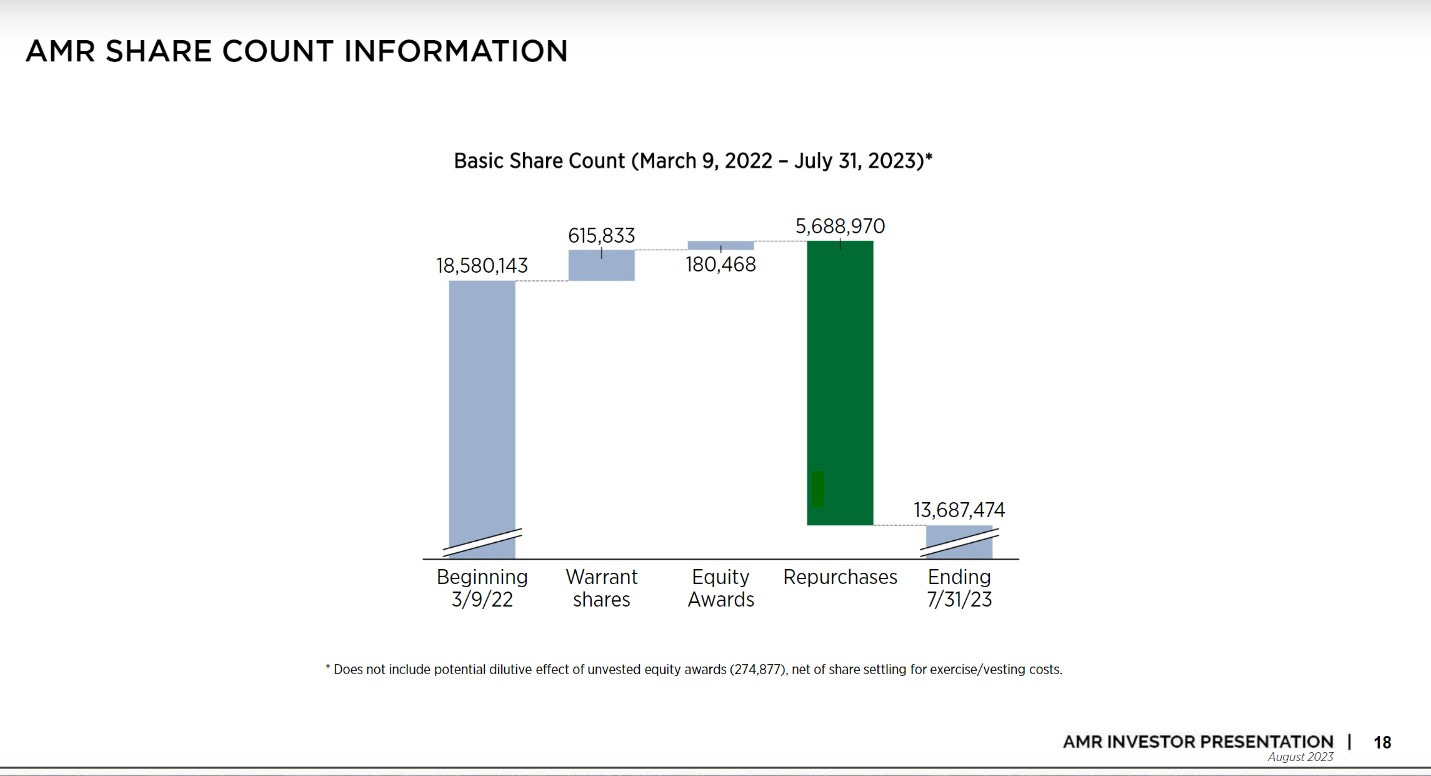

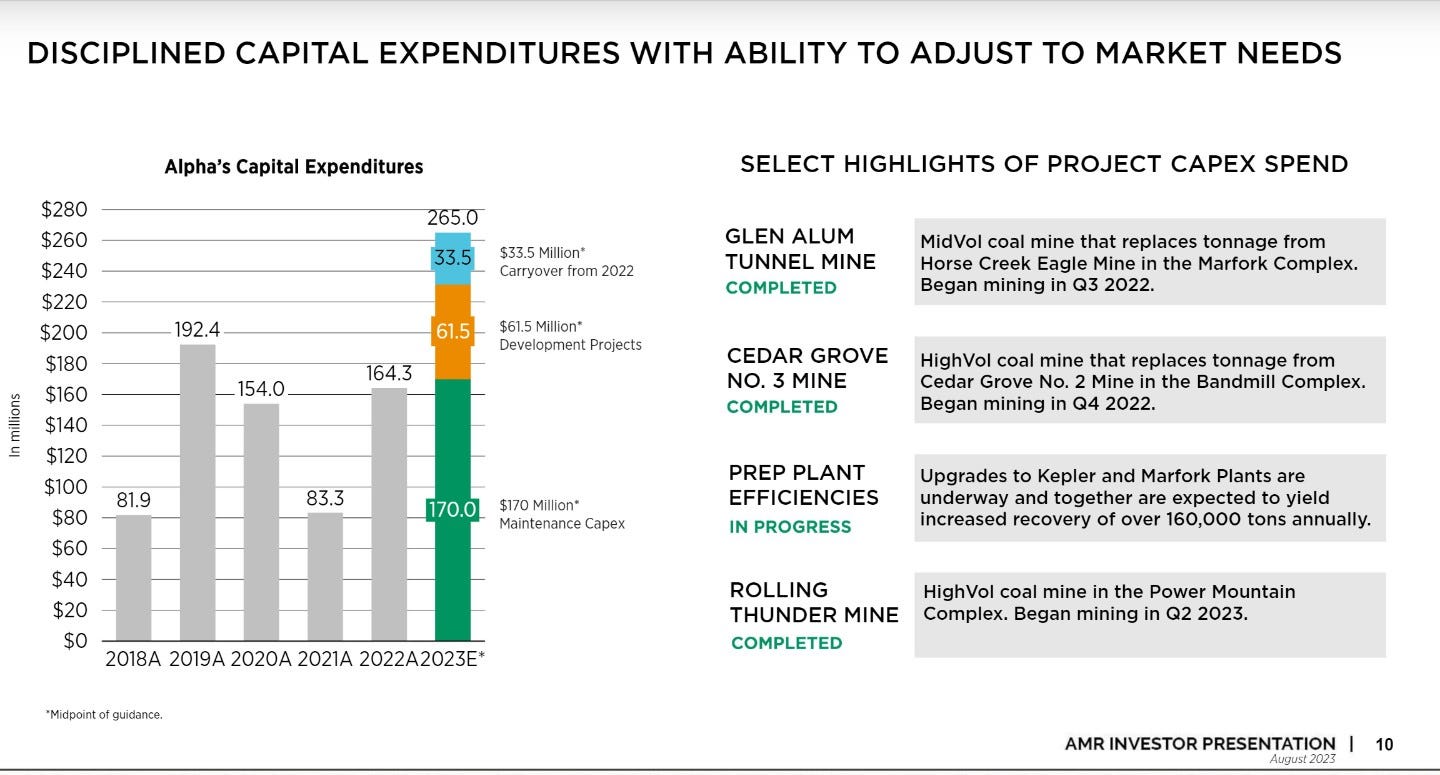

I think the final piece of the jigsaw was making sure that the generated cash flows were actually being returned to shareholders. Although I’m putting this at the end, I think it is likely that this would be one of the first things Mohnish would have been checking out for in a ‘no brainer’ opportunity like this. The amount of cash flow generated would be largely irrelevant if management weren’t focused on returning it to shareholders and were instead making speculative investments in say either resource exploration or new energy sources, at which point all bets on would be off from an investment point of view. In the case of AMR they make it very clear that they are committed to trying to get as much cash back to shareholders as possible. If you take a look at figure G and H, you can see management was committed to a $1.2bn buyback programme of which $850m had already been completed, buying back 28% of the company's outstanding shares, as well as a dividend programme. Looking at Figure I, you can see this compares to only c.$62m in discretionary growth capital expenditure, which really emphasises management's focus on shareholders returns.

Figure G - AMR Presentation Q2 23

Figure H - AMR Presentation Q2 23

Figure I - AMR Presentation Q2 23

Okay well that's it for this post. Thanks for reading and I hope you enjoyed this and it provided you with something of value. If you did enjoy reading please feel free to hit the subscribe button below and of course reach out on Twitter @louisinvesting. I would love to know if there is anything I missed, overlooked or got completely wrong so please leave comments with any thoughts. I look forward to seeing you back for the next post. Cheers, Louis.